Margin and leverage

Trading margined derivatives (such as futures) allows you to create leveraged positions, meaning you only need some of the notional value of an instrument to place orders.

Margin is the amount of the market's settlement asset that's required to keep your positions open and orders funded. You can think of margin as the 'down payment' to open a position. Leverage, meanwhile, describes how many times larger is the notional value of that position compared to the margin you have dedicated to it.

For example, if you need 20 DAI to open a position worth 100 DAI: your leverage is 5x and your initial margin is 20% of the full value.

Hypothetical changes in a position's value are called unrealised profit and loss.

Margin modes

Cross margining provides a capital-efficient use of margin, particularly when trading on multiple markets using the same settlement asset. You can't control the amount of margin (and thus leverage) that you use on your position but the market sets money aside and returns it if it's not required.

Overall, the margin tolerance of open orders and positions is determined by the market's risk model and market conditions. The larger the position and the more volatile the market, the greater the amount of margin that will need to be set aside. The volatility tolerance of the market is driven by the risk model.

Cross margining

Cross-market margin allows you to trade in a capital-efficient way. Cross margining means gains on one market can be released and used as margin on another. It's supported between all markets that use the same settlement asset.

The amount of margin set aside can change depending on how your position is impacted by your own actions and price movements in the market. Orders that increase your open volume will increase the required margin. Orders that decrease it should not increase your margin requirements - unless you end up opening a position in the opposite direction.

Over the course of the position's lifetime, the margin requirements are likely to change - the margin account may be topped up, and/or some margin is released back to collateral. If you are trading on more than one market that uses the same asset, the collective positions on those markets will inform how much is to be set aside for margin.

[margin account balance] = [initial margin requirement] + [unrealised profit] OR - [unrealised losses]

The margin amount required for cross margining is recalculated every time marking to market is done. The protocol takes the current market price and recalculates every trader's margin requirements based on how their position is affected by price moves.

Whitepaper: Automated cross margining ↗ - Section 6 of the protocol whitepaper.

Margin requirements

The Vega protocol calculates margin levels, which are used to determine when a trader has the right amount, too much, or not enough margin set aside to support their position(s).

The margin levels try to ensure that a trader does not enter a trade that will be closed out immediately.

Not all levels are relevant to both margin methods.

The margin levels for active positions are:

- maintenance margin - relevant for cross margin

- initial margin - relevant for cross margin

- search level - only for cross margin

- collateral release level - only for cross margin

The maintenance margin (minimum amount needed to keep a position open) is derived from the market's risk model and includes some slippage calculations. This is applicable to positions using either margin mode.

All other margin levels are based on the maintenance margin level.

Margin level: Maintenance

Throughout the life of an open position, there is a minimum required amount to keep a position open, even through probable adverse market conditions, called the maintenance margin.

The amount required for your maintenance margin is derived from the market's risk model. Specifically, it's based on a risk measure called the expected shortfall, used to evaluate the market risk of the position and any open orders.

If your margin balance drops below the maintenance margin level, your position may be closed out.

For perpetual futures markets, the margin calculations contain an additional term to capture the exposure of a given position to an upcoming funding payment. The market proposal includes a margin funding factor that determines to what degree the funding payment amount impacts a trader's maintenance margin. This can only increase the margin requirement if a given position is expected to make a payment at the end of the current funding period, but it will never decrease the margin requirement, even if you are expecting to receive a funding payment.

Maintenance margin is calculated as:

maintenance margin = min(mark price x linear slippage factor x |position|, slippage per unit x |position|) + mark price x |position| x risk factor

The risk factor will be different for short and long positions; the risk model provides risk factor long for when position > 0 and risk factor short for when position < 0.

Note that your limit orders are included as well, and the maintenance margin is calculated for the riskiest long or short combination of orders and position.

Margin slippage

Markets include a linear slippage factor to be used in low-volume market scenarios, where the standard slippage calculation isn't sufficient. In effect, it caps the margin level when the market wouldn't be able to support a position's margin increasing.

Margin slippage in a low-volume scenario is calculated as slippageFromFactor = linear factor x position x price.

If there is enough volume on the book, the slippage comes directly from the book and the linear slippage factor isn't used.

Margin level: Initial

The initial margin level has two different functions, depending on which margin mode you're using.

For cross margin mode, it sets the amount that will be transferred from a trader's general account to be used as margin when an order is placed or a trade is executed. The initial margin is more than the absolute minimum needed to support a position, as it offers a cushion to keep a position open as the mark price changes.

The initial margin is scaled from the maintenance margin amount. It's calculated by multiplying the maintenance margin amount by the initial_margin scaling factor, which is set by a network parameter:

[initial margin level] = [maintenance margin] x [initial_margin scaling factor]

The initial margin level being higher than the margin search level (which itself is higher than the maintenance margin level) ensures that a small negative price move won't lead to a situation where the network has to attempt to allocate more collateral immediately after a trade has been entered into.

Margin level: Releasing collateral - cross only

When using cross margin mode, if your margin balance exceeds the collateral release level, the position is considered overcollateralised. The excess money is released to your general account, to get your margin back to the initial margin level.

Those gains can then be withdrawn or used as collateral for other trades.

The release level is scaled from the maintenance margin amount. It's calculated by multiplying the maintenance margin amount by the collateral_release scaling factor, which is set by a network parameter:

[release level] = [maintenance margin] x [collateral_release scaling factor]

Example: Calculations for cross margin open orders

For those using cross margining, the network calculates the overall long / short position including the submitted order. Depending on which one is larger a long or short risk factor is used for margin calculation. The maintenance margin (for futures) is then a product of the largest position, the corresponding risk factor and the mark price. Risk factors capture the outcome of the probabilistic distribution of future market moves, and are market specific.

Whitepaper: Margins and credit risk ↗ - Section 6 of the protocol whitepaper.

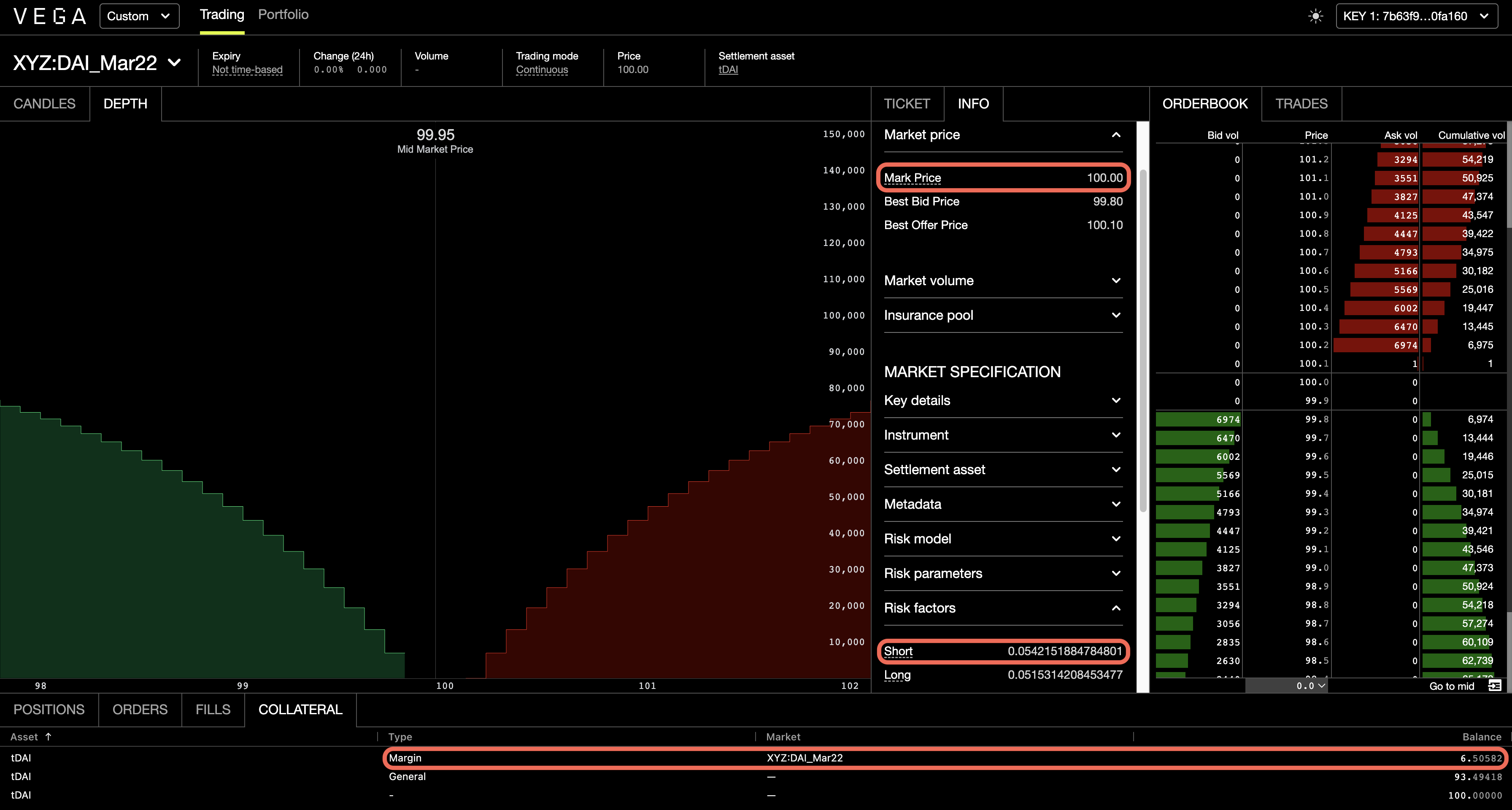

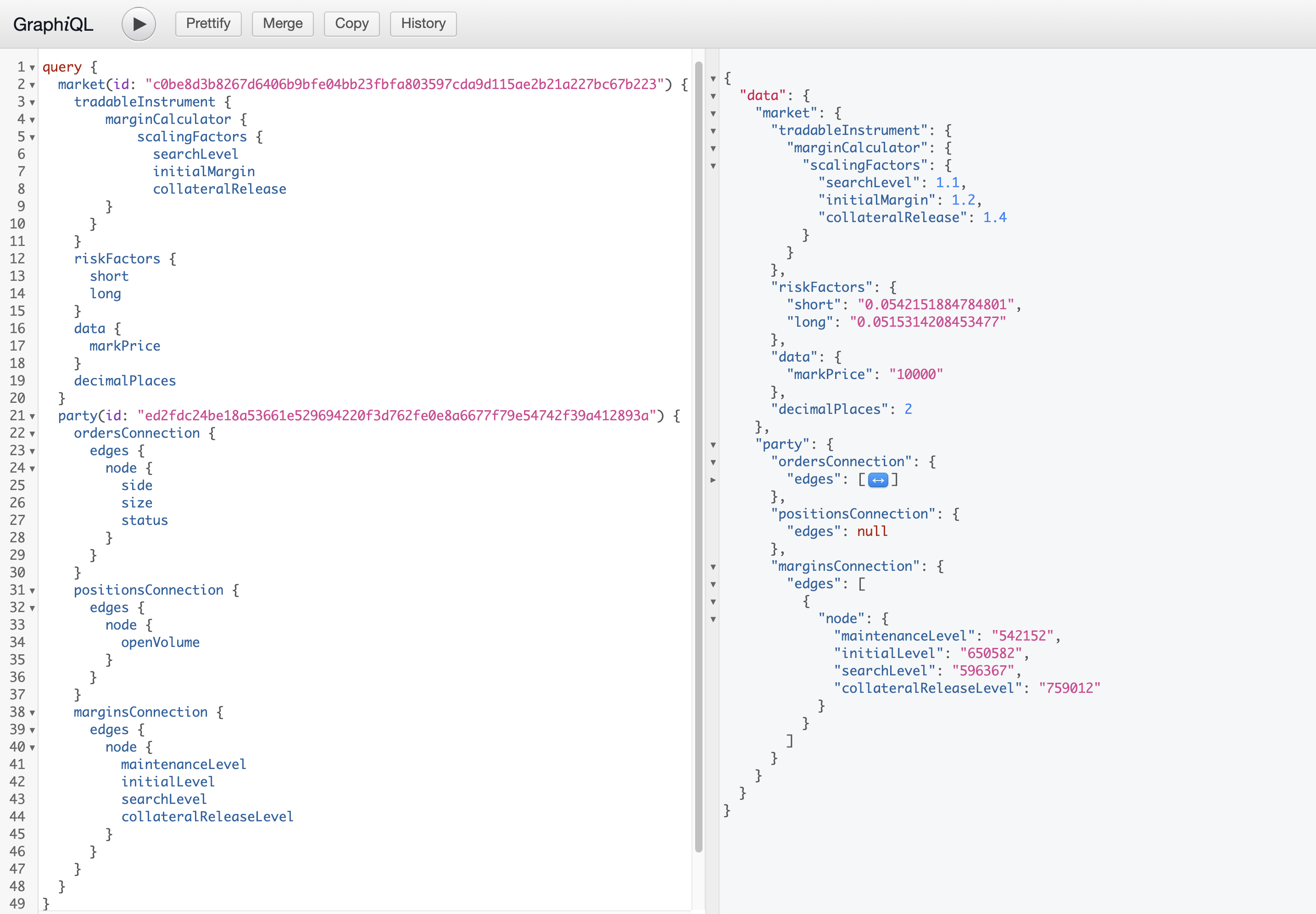

- In the following scenario, the trader, using cross margining mode, posts a sell order of size 1 that doesn't trade on submission and ends up being added to the order book

- Short risk factor is 0.05421518

- Current mark price is 100.00

maintenance margin = 1 x 100 x 0.05421518 = 5.42152(rounded up to 5 decimal places)

The initial margin scaling factor for the market (αinitial) is 1.2 so the amount of collateral that gets moved to the trader's margin account for the market is 1.2 x 5.42152 = 6.50582.

Seen on Vega Console

Queried using GraphQL

Example: Calculations for cross margin open position

The following calculation takes into account slippage, as seen on an order book.

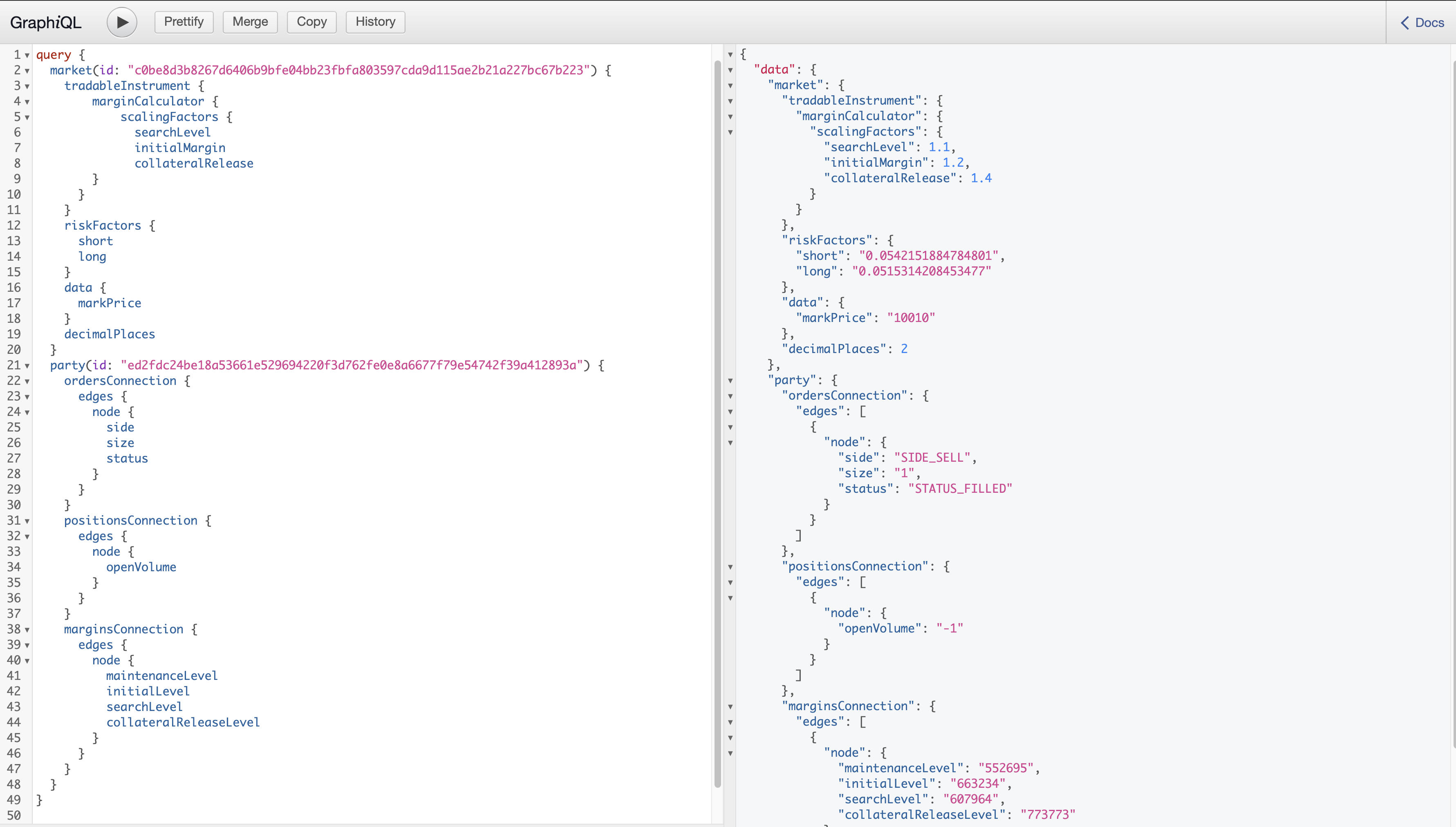

- In the following scenario, the trader has an open short position of size 1, and no open orders, using the cross margining mode

- Short risk factor is 0.05421518

- Current mark price is 100.10

- Best offer price is 100.20 and it has enough volume so that theoretically the position could be closed-out at that price

maintenance margin = 1 x (100.10 x 0.05421518 + max (0, 100.20 - 100.10)) = 5.52695(rounded up to 5 decimal places), where the second term in the sum is the 'slippage' component

Other margin levels are derived from the maintenance margin using the scaling factors that form part of the market configuration.

Since the amount charged to trader's margin account upon order submission (6.50582 - see previous example) is still above the current (after the order gets filled and trader ends up with a short position of size 1) search level of 6.07964 = 1.1 x 5.52695, no further margin account balance changes are initiated.

Seen on Vega Console

Queried using GraphQL

Mark to market

Marking to market refers to settling gains and losses due to changes in the market value. Marking to market aims to provide a realistic appraisal of a position based on the current market conditions.

If the market price goes up, traders that hold long positions receive money into their margin account – equal to the change in the notional value of their positions – from traders that hold short positions, and conversely if the value goes down, the holders of short positions receive money from the holders of long positions.

The mark to market frequency is controlled by a network parameter: 🔗network.markPriceUpdateMaximumFrequency: 5s.

Mark to market settlement instructions are generated based on the change in market value of the open positions of a party. When the mark price changes, the network calculates settlement cash flows for each party, and the process is repeated each time the mark price changes until the maturity date for the market is reached.

When a dated futures market settles at expiry, the mark price comes from the market data source's final settlement price.

Mark price

The mark price represents the current market value, and is used to determine the value of a trader's open position against the prices the trades were executed at, to determine the cash flows for mark to market settlement and funding payments.

The default mark price is the last traded price. Mark price calculations can also use additional price synthesis methods that can take into account trades, the order book, oracle inputs and update recency and can be combined via medians or weighted means.

For perpetual futures markets, there’s also the market price for funding payments, the calculations can also use additional price synthesis methods the same way as the mark price.

How mark price is calculated is configured per market, and can be changed with a governance proposal to update a market.

Mark price algorithms

The current mark price algorithms that can be used in a market configuration are described below. The configuration can apply to mark price, and for perpetual futures markets, the internal price.

Last traded price

When the mark price is set to be the last traded price, this means it is set after each order transaction is processed from a sequence of transactions with the same timestamp, provided that at least 🔗5s have elapsed since the last mark price update.

For example, say the maximum frequency is set to 10 seconds.

The mark price was last updated to $900, 12 seconds ago. There is a market sell order for -20 and a market buy order for +100 with the same timestamp.

The sell order results in two trades: 15 @ 920 and 5 @ 910. The buy order results in 3 trades: 50 @ $1000, 25 @ $1100 and 25 @ $1200.

The mark price changes once to a new value of $1200.

Now 8 seconds have elapsed since the last update. There is a market sell order for 3 that executes against book volume as 1 @ 1190 and 2 @ 1100. The mark price isn't updated because the 10 second maximum frequency has not elapsed yet.

Then 10.1 seconds have elapsed since the last update and there is a market buy order for 5 that executes against book volume as 1 @ 1220, 2 @ 1250 and 2 @ 1500. The mark price is then updated to 1500.

Flexible mark price methodology

The mark price methodology can also be fine-tuned per market:

- Decay weight is a parameter controlling to what extent observation time impacts the weight in the mark price calculation. 0 implies uniform weights.

- Decay power is a parameter controlling how quickly the weight assigned to older observations should drop. The higher the value, the more weight is assigned to recent observations.

- Cash amount, in asset decimals, used in calculating the mark price from the order book. The cash amount is a sample value to be set depending on the market's expected liquidity/volume. This value should be the margin amount of the expected typical trade size, at maximum leverage. For example, take a BTC/USDT market. If the traders would typically use 10 USDT for margin at maximum leverage (on a 100x market this would mean trade notional of 1000 or about 0.02 BTC if BTCUSD is 50000) with a typical trade of 0.02 BTC, then it should be set to 10 USDT.

- How it's used: a. Chosen cash amount is scaled by the market's leverage b. The execution price of a theoretical buy market order of the notional in a. is used alongside c. The execution price of a theoretical sell market order of the notional in a. d. mark price = 0.5 x (b. + c.)

- Weights determine how much weight goes to each composite price component. The order of sources used is as follows: price by trades, price by book, oracle_1, ... oracle_n, median price.

- Staleness tolerance for data source. How long a price source is considered valid. This uses one entry for each data source, such that the first is for the trade-based mark price, the second is for the order book-based price, and the third is for the first oracle, followed by any other data source staleness tolerance.

- Type of composite price, weighted, median or last trade.

- Weighted: Composite price is calculated as a weighted average of the underlying mark prices.

- Median: Composite price is calculated as a median of the underlying mark prices.

- Last trade: Composite price is calculated as the last trade price.